Company

Connecting patients and providers through game-changing technology.

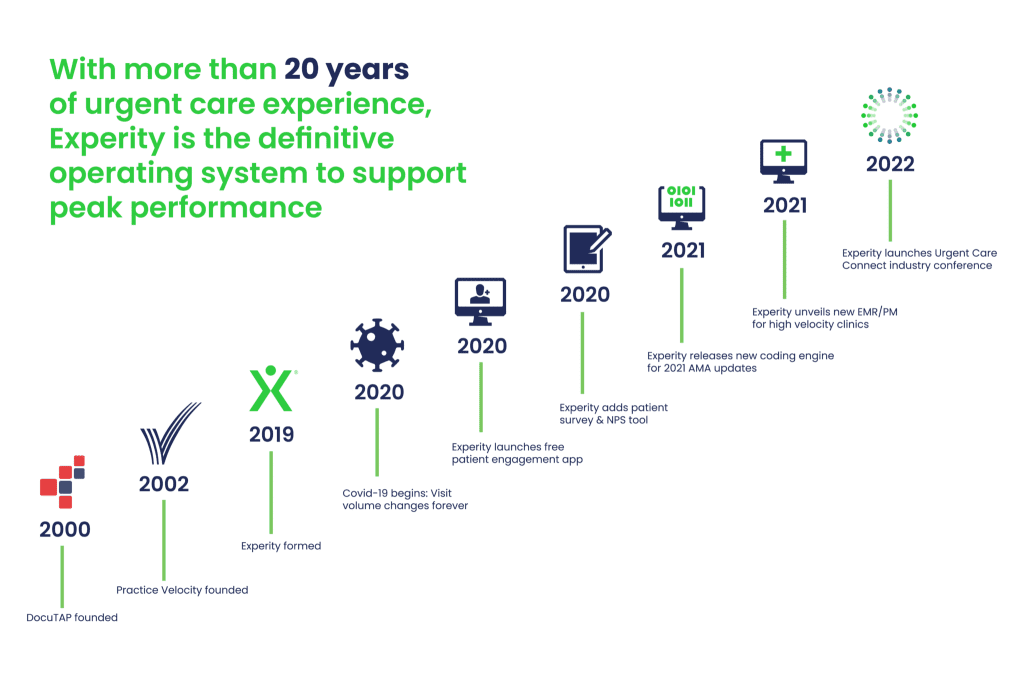

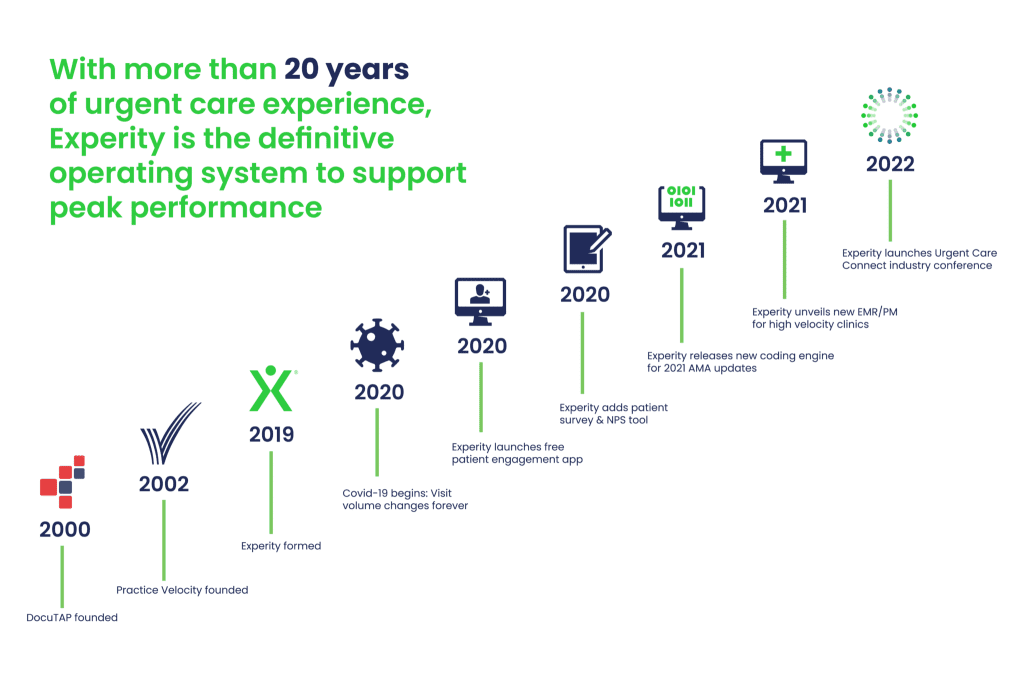

We’ve been Experity since 2019, but our history goes back to the beginning of the 21st century when two forward-thinking and industrious entrepreneurs started innovative companies to help urgent care clinics move from paper to digital medical records. These two companies merged in 2019 to form Experity. We have team members who have been with us since the very beginning, including our CEO and founder, David Stern.

Today, Experity has nearly 700 employees. Our headquarters is in Machesney Park, Illinois, and we have five satellite offices in Sioux Falls, South Dakota; Atlanta, Georgia; Springfield, Missouri; and Bloomington, Minnesota.

Together, our teams strive to meet the company’s goals in a supportive and challenging work environment and enjoy competitive compensation and benefits. We believe in fostering an atmosphere of collaboration and creativity, and we are committed to helping our employees reach their full potential.

We power the patient-centered healthcare revolution.

Driven by the power of efficiency, the spirit of innovation, and the relentless focus on putting people at the heart of healthcare, our technology solutions work for urgent care. While you take care of your patients, we’re finding ways to improve your business.

Effective solutions that solve urgent care-specific challenges

Resources that bring game-changing technology and services to the market faster

People that understand the business of on-demand healthcare

Technology that boosts urgent care efficiency

Our vision is to become the indispensable operating system for on-demand healthcare.

Every member of our team is encouraged to think and act as an owner. Because most of them are.

In on-demand healthcare, change happens every day. We make every decision with the future in mind.

When you play on our team, you are challenged to bring your best every day — and then some. It makes us better. It makes you better.

As the industry grows, the demand for our solutions grows, too. We hire the right people, with the right attitude, and the right talent to set the pace.

Our people make us distinctly powerful and powerfully distinct.

Our team is comprised of problem-solvers and change-makers with big ideas and a determination to impact healthcare in positive ways for practitioners and patients. Whether they’re supporting a customer, developing a new software solution, or making sure your connections are compliant, they give their all to make clinics runs smooth and improve patient satisfaction.

Collectively, they impact your business, our business, and the industry in positive ways – and we couldn’t be prouder.

We’re committed to changing healthcare for the better with transformational innovation that removes complexities, simplifies operations, and keeps patients at the center of the solutions we build and the services we provide.

We have the resources and expertise to move forward with confidence, speed, and deliberate attention, offering unprecedented outcomes for patients, providers, and operators.